For example, imagine a company reports $1,000,000 of cash on hand at the end of the month. Without context, a comparative point, knowledge of its previous cash balance, and an understanding of industry operating demands, knowing how much cash on hand a company has yields limited value. When analyzed over time or comparatively against competing companies, managers can better understand ways to improve the financial health of a company.

How to Find the Common Stock on a Balance Sheet in Accounting

On the other side of the ledger are liabilities, which are what the company owes. If a company is healthy, the total assets will be larger than the total liabilities. The residual amount left to the owners is known as shareholders’ equity and is represented by a company’s shares. Another reason for calculating common stock on the balance sheet is to help investors make informed investment decisions. Investors use the balance sheet to evaluate a company’s financial health and potential for growth.

Understanding the Value of Common Stock in Financial Reports

By mastering this calculation, individuals gain a deeper understanding of a company’s capital structure, its ability to raise funds, and the potential dilution of ownership interests. Armed with this knowledge, stakeholders are better equipped to evaluate investments and gauge the financial strength of a company. Liabilities are obligations that a company owes to creditors or other parties.

- One of the most appealing features of preferred stock is its predictable, fixed dividend payments- if there are distributions.

- When common stock has an assigned par or stated value, multiply the number of shares outstanding by the par or stated value per share.

- Meanwhile, value stocks are priced lower relative to their fundamentals and often pay dividends, unlike growth stocks.

- Explore our finance and accounting courses to find out how you can develop an intuitive knowledge of financial principles and statements to unlock critical insights into performance and potential.

Ask Any Financial Question

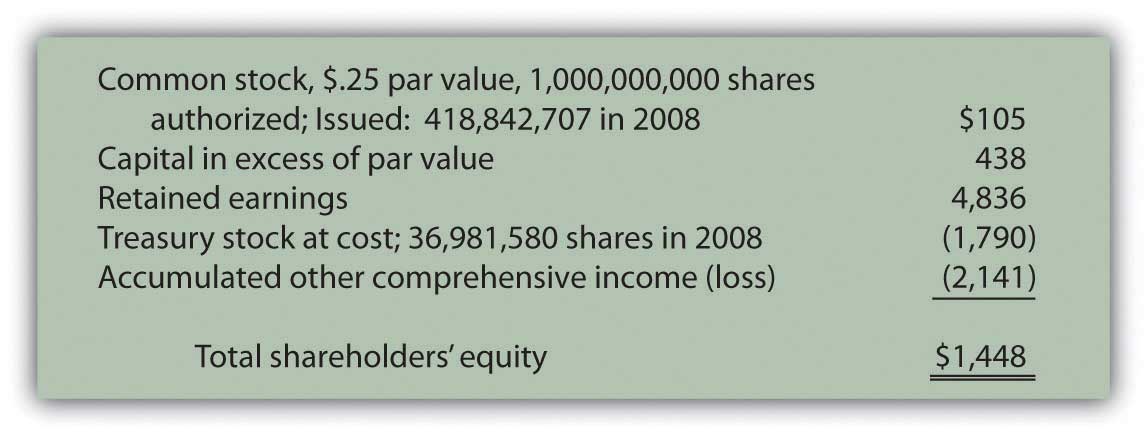

The liabilities section is broken out similarly as the assets section, with current liabilities and non-current liabilities reporting balances by account. The total shareholder’s equity section reports common stock value, retained earnings, and accumulated other comprehensive income. Apple’s total liabilities increased, total equity decreased, and the combination of the two reconcile to the company’s total assets. Stockholders’ equity is the remaining assets available to shareholders after all liabilities are paid.

Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

How Do I Evaluate Market Share Prices for Common Stock?

HBS Online’s CORe and CLIMB programs require the completion of a brief application. The applications vary slightly, but all ask for some personal background information. If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for enrollment for any HBS Online program.

A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. Often, the reporting date will be the final day of the accounting period. Another important distinction between the two types of stock relates to what happens when a company is liquidated. In the investor hierarchy, preferred stockholders are paid out first before common stockholders when a company goes bust.

Traded on exchanges, common stock can be bought and sold by investors or traders, and common stockholders are entitled to dividends when the company’s board of directors declares them. Common stock in balance sheet is a representation of the journal entry of all the common stocks that have been issued by a company. In every financial management 23 best inventory management apps setup, it is important that an accurate record of transactions, assets, liabilities, and equity of the company be kept. Items such as the different types of stock (common and preferred) are also recorded on the balance sheet. In this article, we will show how to enter or record issued common stocks on a balance sheet for a company.

When valuing preferred stock, this formula helps investors assess the present value of the stock based on the fixed dividends and the expected return rate (discount rate). The dividend is usually fixed and determined when the stock is issued, while the discount rate reflects the required rate of return for investors. The distinct features attached with common stock and preferred stock discussed above appeal to different classes of investors. Thus, rather than relying only on common stock, many corporations prefer to issue both types of stock to attract as many investors as possible.

As an example, let’s say that a fictional business, the Helpful Fool Company, has authorized 5,000 shares. Common stock is included in the « stockholders’ equity » section of a company’s balance sheet. Treasury shares would be deducted from total shares only when they exist. Common stock offers several advantages, particularly for investors who are looking to benefit from a company’s growth over time.

If a company or organization is privately held by a single owner, then shareholders’ equity will be relatively straightforward. If it’s publicly held, this calculation may become more complicated depending on the various types of stock issued. Class A shares are available via the GOOGL ticker and come with voting rights. Class C shares are available via the GOOG ticker and do not carry voting rights. Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company. In this example, Apple’s total assets of $323.8 billion is segregated towards the top of the report.